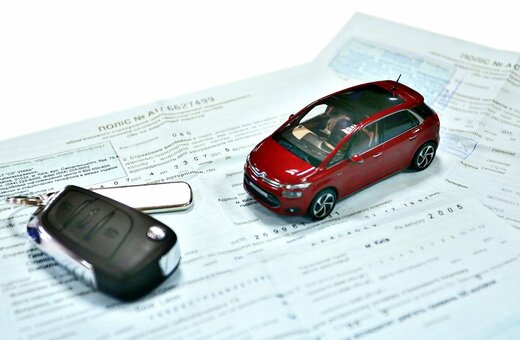

OSAGO: How? Where? When?

Imagine how wonderful the life of a driver would be if he knew how to predict what will happen in the next moment. How much less dented bumpers, bent road signs and bumpers, knocked down fences, pedestrians, rammed bus stops and shop windows become less ... But, unfortunately, this is more of a utopia. It is impossible to calculate all the risks, but you can insure yourself and your vehicle before an accident, without getting into debt, in case someone else's Range Rover is repaired. Even if you learned to drive while in the womb, a simple speck of dust accidentally caught in the eye, or a glare of sunlight will quickly correct your perfect driving skills.

The specialist of the Hotline Finance insurance department told us about the benefits of compulsory motor third party liability insurance, where and how to issue it, and why we should not forget to renew the policy.

- What is OSAGO and what is it for?

- OSAGO, also nicknamed by the people "avtocivilka" or "avtograzhdanka", is a compulsory motor third party liability insurance. With this policy, in the event of an accident, the material damage caused to the injured party is compensated by the insurance company of the person responsible for the accident.

- Where to issue OSAGO?

- The time when it was necessary to run around the insurance companies, looking for the most favorable conditions and prices, has passed. Although, there are still fans of such hardcore.

Now a computer or smartphone with Internet access is enough for registration. Any search engine will offer you a large number of online insurance services for comparing and issuing a policy remotely, spending about 15-20 minutes on it. One of these is https://hotline.finance . This platform will help not only with the registration of insurance, but also provide an opportunity to compare, filter and purchase a banking service.

- How to get an insurance policy and for how long?

- To apply for OSAGO at https://hotline.finance, do the following:

- Make some tea or coffee and go to the "Online OSAGO" section https://hotline.finance/osago .

- Enter the parameters of the vehicle: type, engine size, city of registration of the owner, benefits (if any).

- After clicking "Calculate cost", the system displays a list of available offers from insurance companies.

- You browse, study, choose the most profitable option and issue a policy through "Buy Online".

- Enter the license plate in the format XX0000XX or 00000XX (manufacturer, model, body number will be automatically pulled from the open state register), year of manufacture of the vehicle, personal data of the insured (full name, TIN, driver's license, passport or ID card data), etc.

- Make a payment. This can also be done online using a MasterCard or Visa.

- Done, the tea has not yet cooled down! The insurance will be sent to your mail in PDF format immediately after payment, and will start to operate the next day.

Long live the time of information technology!

- How much will the insurance cost?

- There is no exact, fixed amount. The cost of insurance for each will be different and depends on several factors:

- Vehicle type (car, truck, bus, trailer, motorcycle, etc.).

- Engine displacement (for a car and motorcycle), carrying capacity (for a truck), number of passenger seats (for a bus).

- Place of registration of the vehicle owner.

- Driver experience.

- Availability of benefits.

- The validity period of the policy.

- The presence or absence of a franchise. Deductible (from French - benefit) is a part of expenses that is not paid by the insurance company. The CMTPL agreements provide for the right to a zero deductible. True, the price of a policy without it is 5-10% more expensive compared to insurance with a minimum deductible, but with it the insurance company takes over all payments.

- What if you “scored” or forgot to insure?

- According to the law of Ukraine "On compulsory insurance of civil liability of owners of land vehicles " , all drivers, except for invalids of war, the first group, drivers of cars that are owned by invalids of the first group and participants in hostilities, are OBLIGED to purchase OSAGO. What is a little paradoxical is that the police have the right to check the presence of the policy only in the event of a traffic violation or an accident. That is, technically, you can drive without insurance, but if you do "enter", you will pay out of your own pocket not only for the repair of your own and someone else's vehicle, but also a fine for the absence of OSAGO.

- How to remember the validity period of OSAGO and where to clarify, if you have forgotten it?

- If you are a happy owner of a paper policy, then its validity period is indicated in paragraph 3 under the name "Strok diy". For those who do not like to fiddle with "papers", it is enough to open the aforementioned PDF file (electronic insurance) on the phone or other device and look at the item "Lines of the contract".

It happens that suddenly you urgently need to open insurance, but you did not save it and, as luck would have it, the Internet disappeared. This is not a tragedy - install a special mobile application from hotline.finance on your phone that works offline and you will always have a policy and a contact number of the insurance company at hand.

It also happens that you know where to look at the end date of the "autocivil", but forgot to do it, but it was not at hand. To solve this problem, there is also a huge number of "reminder applications": immediately after registration, set the necessary requirements and at a given interval the phone or computer will tell you: "Vasily, have you forgotten anything? RUNNING FOR OSAGO! "

When getting behind the wheel, always remember that OSAGO is an investment in your security, a kind of deposit that gives a guaranteed financial cushion of safety. Of course, it is better that it never works, but if it does, you will not regret that you spent a few minutes on https://hotline.finance/ua/osago and took out an insurance policy. By purchasing OSAGO today, you protect your nerves and your wallet tomorrow!